More than two years after the spread of the COVID-19 pandemic, Filipinos raring for a restart actually improved their mindset towards saving money, according to a recent survey by the Bangko Sentral ng Pilipinas (BSP).

This is a welcome development, considering that 34% of the population lost their source of income during pandemic years, based on a survey conducted by the United Nations Development Programme. As a result, many have relied entirely in their savings account in order to survive the last two years.

According to the BSP’s Consumer Expectations Survey for the first quarter of 2022, the percentage of household with savings increased marginally at 31.1 percent from 30.2 percent in Q4 of 2021.Majority of the respondents cited the need for emergencies, health and medical expenses, retirement, education, and business capital and investment as reasons to save their money.

A big help in this increase in mindset and enthusiasm is the availability of more options to save money, aside from traditional banking institutions.

Cebuana Lhuillier makes life easier and dreams come true with Micro Savings

One of the most innovative means to save is through Cebuana Lhuillier Micro Savings. Launched in 2019 by Cebuana Lhuillier and its banking arm Cebuana Lhuillier Bank, this product has been in the forefront of bringing easy, accessible, reliable banking to majority of Filipinos, with close to seven million micro savings account holders today.

“Cebuana Lhuillier Micro Savings empowered millions of Filipinos to embark on their very own financial journeys by giving them a reliable, accessible, and efficient way to save their money, which they can easily withdraw during times of need. The quick adaptation of our kababayans to micro savings proved that the healthy mindset towards saving has always been there, as long as they are equipped with the right tools,” says Jean Henri Lhuillier, president and CEO of Cebuana Lhuillier.

Cebuana Lhuillier Micro Savings—which allows customers to open an account in any of over 3,000 Cebuna Lhuillier branches nationwide for as low as only P50—was introduced as a means to address the barriers to saving, including lack of accessibility, high maintaining balance, and the need for numerous documentary requirements to open an account.

With businesses and the rest of the country slowly getting back to normal, Cebuana Lhuillier Micro Savings remained a go-to product for many of our kababayans ready to resume their lives and dreams following two years of uncertainty.

|

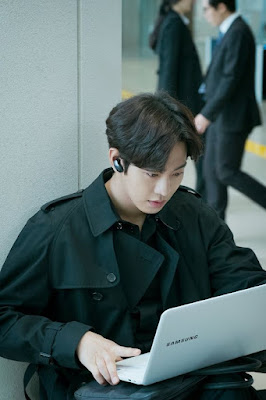

James Tan, 18 years old, a working student from Laguna,

who easily managed to save with Micro Savings to buy his own bike |

For James Tan, an 18-year-old working student from Sta. Rosa, Laguna, saving meant enjoying the added mobility, safety, and convenience of having his own bike, a useful tool for his daily commute between work and school.

“Gusto ko kasi magka-bike kasi sapamasahe pa lang, malaki na matitipid ko papunta sa school at sa trabaho. So, yung paunti-unti kong pag-iipon sa Cebuana, ginamit ko yun para mabili yung pangarap kong bike. Hindi na ako nata-trapik o nale-late sa trabaho ngayon,” he shares.

(“I want to own a bike because I can save so much on fares commuting to school and work. So that’s why I saved with Cebuana enough to buy my own bike. Now I don’t get stuck in traffic and come to work late.”)

As a working student helping to support his family, James decided to continue his savings after buying the bike to also help augment the expenses from home.

|

Royce Jason Velez, a 36-year old construction worker

who saves using Cebuana Lhuillier Micro Savings account

to provide a better future for his family |

The need to provide a better future for their family is also why Royce Jayson Velez, a 36-year-old construction worker, decided to open a Micro Savings account. Earning an average of P400 per day, Royce and his wife needed to be creative in order to stretch his salary to last until the next payday. His micro savings carried the family during difficult times, and are now being allocated for the schooling of his children.

“Sabi ko sa sarili ko, ipagpapatuloy ko ang ipon ko para magamit ng mga anak ko sa pag-aaral at balang araw, magkaroon sila ng magandang trabaho,”Velez shares.

(“I said to myself that I would continue saving so that I can send my children to school for them have good jobs in the future.”)

|

A former kasambahay, Carie Labro, 38-years old,

was able to put up her own sari-sari store

using Cebuana Lhuillier Micro Savings |

For Carie Labro, a 38-year-old former housekeeper, her micro savings paved the way for her micro entrepreneurship. When her kids started asking for more time to spend with her, Carie decided to take a leap of faith and resign from her post as a housekeeper so she could be more present for her growing kids.

With the PHP10,000 she initially saved in her Micro Savings account, Labro opened a small store which she now maintains as her main source of income. Like Velez, she has vigilantly kept up with her micro savings. She now saves part of her earnings in her account as an emergency fund for her and her kids.

Taking advantage of the renewed interest in saving, Cebuana Lhuillier Bank continues to push for accessibility and convenience for their breakthrough product. The two-time Asian Banking & Finance Award winner for Rural Bank of the Year has adapted an innovative approach by adapting more tech features for micro savings.

“The success of Cebuana Lhuillier Micro Savings encouraged us to further push the envelope in bringing convenience, accessibility, reliability, and efficient banking to our clients. The change in how people access financial services nowadays served as our push towards digitalization,” said Cebuana Lhuillier Bank President Dennis Valdes.

Aside from Cebuana Lhuillier branches, micro savings accountholders can also withdraw cash anytime, anywhere in over 21,000+ BancNet ATMs nationwide, purchase online thru UnionPay merchants worldwide, enjoy 24/7 unlimited banking access with the eCebuana app, and make cashless payments in over 350,000 UnionPay and BancNet accredited stores nationwide.